Bitcoin Halving Causes Miner Mergers, Acquisitions And Survival Of The Fittest In The End

Bitcoin Halving Causes Miner Mergers, Acquisitions And Survival Of The Fittest In The End

As the next Bitcoin halving approaches, the once-every-four-year event that slashes mining rewards by 50%, industry experts anticipate a period of intense competition and strategic maneuvers in the mining sector. The impending halving, scheduled for April, is expected to initiate a “survival of the fittest” scenario, prompting larger mining companies to secure efficient machines and potentially engage in mergers and acquisitions (M&A) to navigate the evolving landscape.

- 1 Preparing for the Bitcoin Halving: Strategic Moves by Mining Giants

- 2 Scene of Intense Competition: Industry Consolidation and Order of New Mining Machines

- 3 The Significance of Bitcoin Halving and Historical Context

- 4 Historical Impact on Miners and Challenges in the Current Landscape

- 5 The Impending Consolidation Wave: Mergers and Acquisitions

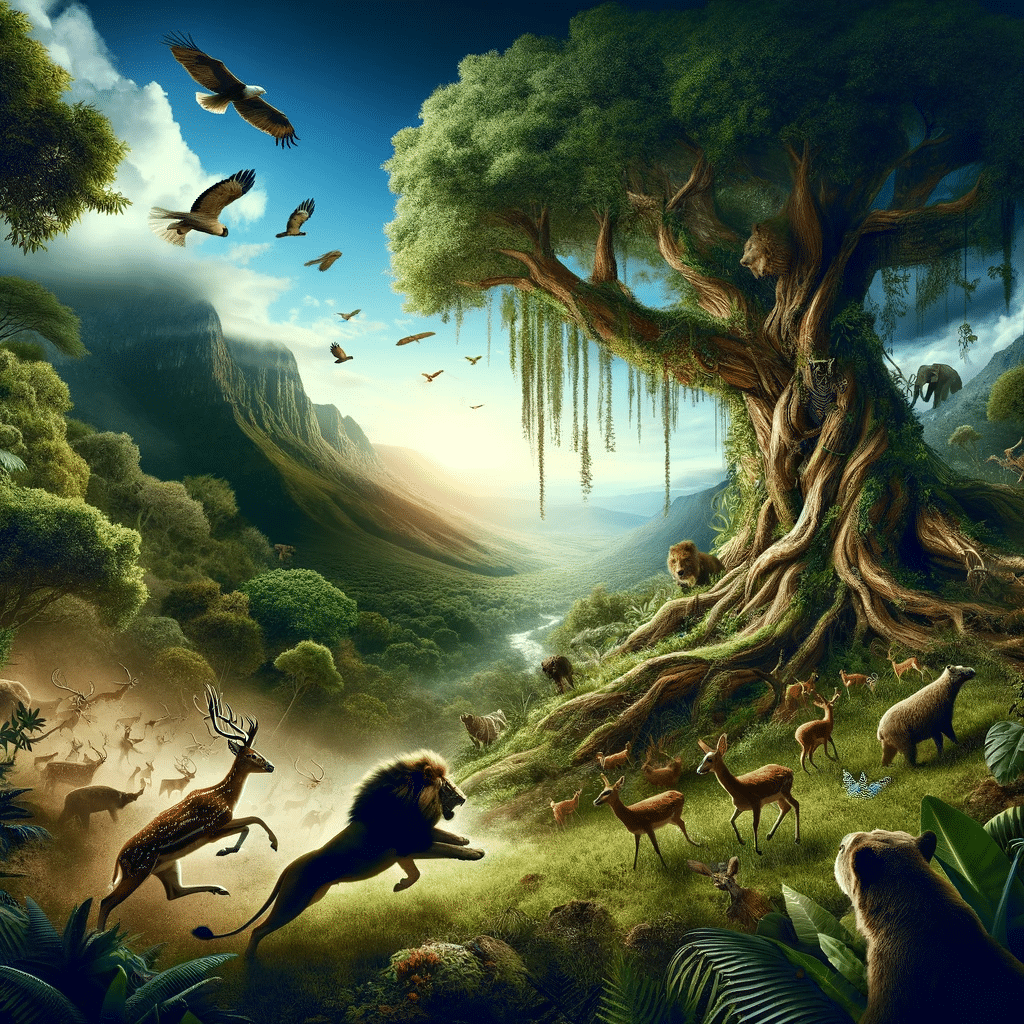

- 6 Miner Darwinism Unleashed by Bitcoin Halving

Preparing for the Bitcoin Halving: Strategic Moves by Mining Giants

Larger mining companies, such as Marathon Digital and Hut 8, are proactively gearing up for the halving by securing advanced mining machines and capitalizing on industry consolidation opportunities. Marathon Digital, the largest publicly traded miner by hashrate, revealed plans to leverage its substantial cash and bitcoin reserves (over $800 million) to capitalize on strategic opportunities and industry consolidation ahead of the halving. Let’s also see if companies will continue to contribute to more sustainable mining operations as well.

Scene of Intense Competition: Industry Consolidation and Order of New Mining Machines

Hut 8 completed an all-stock merger with a privately held US Bitcoin mining company, while Riot Platforms ordered 66,560 new mining machines worth $290.5 million to maintain a competitive edge. The mining landscape is becoming increasingly competitive, prompting a wave of M&A activities as miners seek ways to not only survive but thrive amid the challenges posed by the halving.

The Significance of Bitcoin Halving and Historical Context

The Bitcoin halving is a cyclical event designed to reduce inflationary pressure on the cryptocurrency by halving mining rewards. This scarcity-driven mechanism historically results in increased bitcoin prices, creating challenges and opportunities for miners. The upcoming halving will further reduce mining rewards to 3.125 BTC, intensifying competition and prompting strategic planning among mining companies.

Historical Impact on Miners and Challenges in the Current Landscape

Previous halving events led to exponential increases in bitcoin prices but posed challenges for miners as profit margins fluctuated. The 2022 bear market witnessed several miners facing financial hardships, with some filing for bankruptcy. The 2023 rally in bitcoin prices, driven by optimism regarding U.S. regulatory approval of spot bitcoin ETFs, has provided some relief to miners. However, challenges such as high competition, energy costs, regulatory scrutiny, and limited access to capital persist.

The Impending Consolidation Wave: Mergers and Acquisitions

The post-halving environment is expected to witness a consolidation wave in the mining industry. Struggling miners, facing financial constraints, may seek mergers and acquisitions to cut costs, strengthen balance sheets, and secure additional capital. Industry experts anticipate a range of M&A activities, with private miners potentially merging with public companies to gain access to liquidity.

Miner Darwinism Unleashed by Bitcoin Halving

As the Bitcoin halving approaches, the mining sector braces for a period of intense competition and strategic realignment. Larger miners, armed with significant resources, prepare to navigate the challenges posed by the halving through strategic investments and potential M&A. The survival of the fittest ethos takes center stage, with the mining industry poised for a transformative phase characterized by consolidation and strategic positioning.