13 Crypto Firms Blacklisted by US for Russia Links

13 Crypto Firms Blacklisted by US for Russia Links

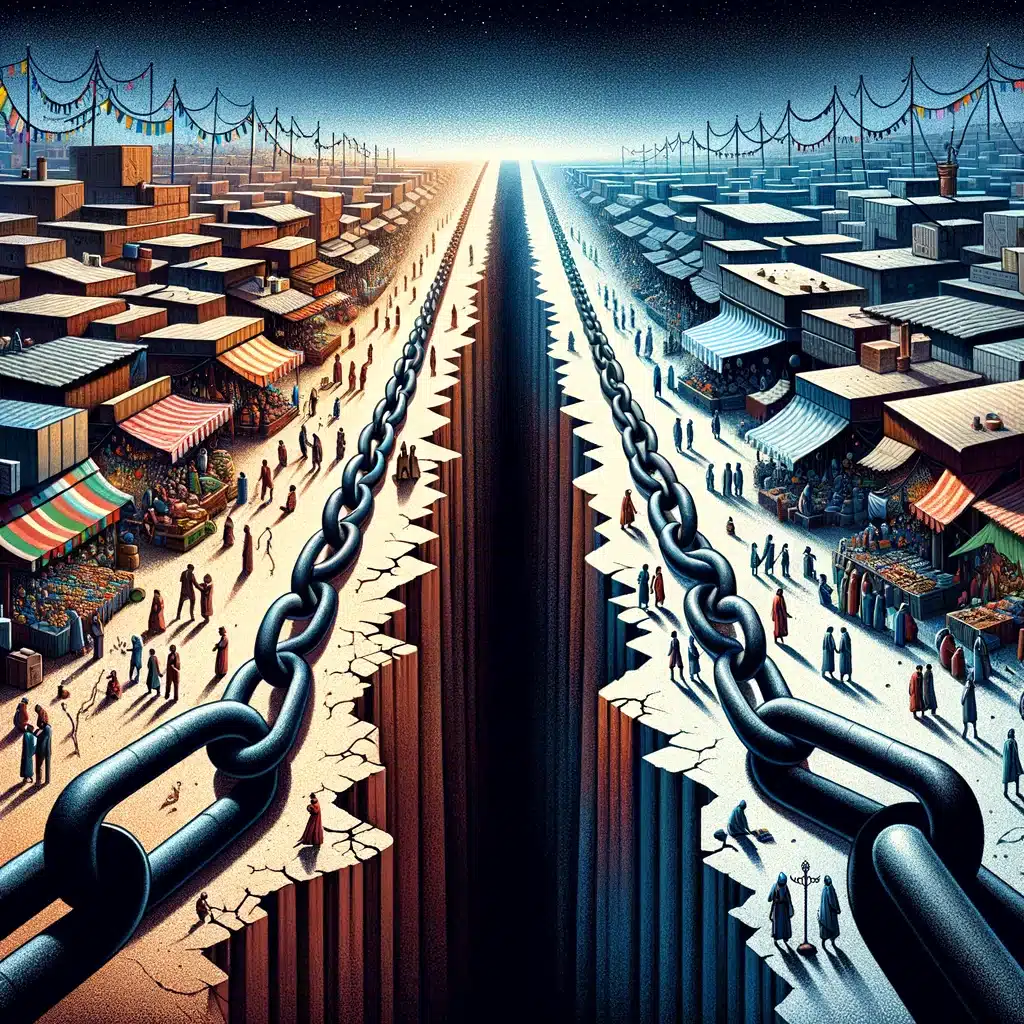

On March 25, the Treasury Department’s Office of Foreign Assets Control (OFAC) announced sanctions against a group of crypto firms tied to Russia, expanding its sanctions reach beyond the major Russian crypto exchanges already on its list. These sanctions encompass 13 new organizations operating across various sectors of Web3, both Russian and international.

Via these sanctions the Treasury wants to disrupt Russian efforts to evade sanctions, especially through the use of virtual assets and technology. This action builds upon previous sanctions aimed at severing Russia’s access to the international financial system and its attempts to support its military actions through alternative financial mechanisms.

Note that For Russia specifically, the subsidized mining center may serve as a means to exert influence over the digital financial landscape, just like they do on agriculture in their aggression towards Ukraine.

Blacklisted crypto firms in (outside) Russia

The blacklisted companies are the following ones:

- B-Crypto, a fintech company headquartered in Moscow, collaborates with the OFAC-sanctioned Rosbank to enable Russian exporters to conduct cross-border settlements using digital currencies. This company has been targeted under Executive Order 14024 for its involvement in the financial services sector of Russia’s economy.

- Masterchain, another Moscow-based fintech firm, holds agreements for issuing blockchain-based digital financial assets with several Russian banks under sanctions by OFAC, including VTB Bank and the Central Bank of Russia. These digital assets represent digital rights. The designation of Masterchain also falls under Executive Order 14024, attributed to its financial sector activities within Russia.

- Laitkhaus, situated in Moscow and operating within the fintech sphere, has partnered with sanctioned entities Sberbank and VTB Bank to manage the issuance, exchange, and transfer of digital financial assets. Like the others, Laitkhaus faces sanctions under Executive Order 14024 due to its operations within the Russian financial services sector.

- Atomaiz, a registered operator of digital financial assets based in Moscow, focuses on tokenizing precious metals and diamonds for Russian enterprises and collaborates with the sanctioned Rosbank and Sovcombank. Atomaiz’s activities have led to its designation under the same executive order for participating in the financial services industry of Russia.

- Tokentrust Holdings Ltd., located in Cyprus and holding the majority stake in Atomaiz, has been sanctioned under Executive Order 14024 for its role in Russia’s financial services sector.

- Veb3 Tekhnologii and Veb3 Integrator, Moscow-based technology firms, offer blockchain solutions and platforms to the Russian financial sector, counting the sanctioned Sberbank and Alfa-Bank among their clients. Both have been sanctioned under Executive Order 14024 for their contributions to the technology sector of the Russian economy.

- Igor Veniaminovich Kaigorodov, the principal shareholder of both Veb3 Tekhnologii and Veb3 Integrator, has been sanctioned under the same order for his involvement in the technology sector of the Russian economy.

- TOEP, also known as Netexchange and Netex24, operates a Moscow-based fintech company facilitating a virtual currency exchange. It enables transactions in rubles and digital currencies with sanctioned entities like Sberbank, Alfa-Bank, and Hydra Market. TOEP has been sanctioned under Executive Order 14024 for its operations in the financial services sector of Russia.

- Timur Evgenyevich Bukanov, owner and director of TOEP, faces sanctions under the same executive order for his role in Russia’s financial services industry.

- Bitfingroup OÜ, an Estonian firm listing Bukanov as its sole proprietor, has been designated for being under his ownership or control, or acting on his behalf, directly or indirectly.

- Bitpapa IC FZC LLC, a peer-to-peer virtual currency exchange, serves Russian nationals and has engaged in significant transactions with the sanctioned Russian entities Hydra Market and Garantex. Bitpapa has been designated under Executive Order 14024 for its financial services activities within the Russian economy.

- Crypto Explorer DMCC, trading as AWEX, operates a virtual currency exchange based in Russia and the UAE, facilitating conversions between digital currencies, rubles, and UAE dirhams. It provides cash services in Moscow and Dubai and loads funds onto cards linked to sanctioned Russian banks like Sberbank and Alfa-Bank. This designation under Executive Order 14024 is due to its operations in the financial services sector.

- OOO Kripto Eksplorer, a Russian entity solely owned by Crypto Explorer, has been designated for being controlled by, or acting for or on behalf of, Crypto Explorer, directly or indirectly.

Simply do not engage with Russia’s military-industrial base

Among the entities we find Bitpapa and Crypto Explorer, which are UAE-based exchanges with strong Russian connections. They faced sanctions for their peer-to-peer and currency conversion services that closely tie them to the Russian market. Specifically, Bitpapa was sanctioned for its services to Russian nationals, while Crypto Explorer was noted for facilitating transactions involving rubles and dirhams, including services in Moscow and Dubai that directly support sanctioned Russian banks.

The sanctions also targeted technology providers in the blockchain space, including Atomaiz, for tokenizing assets for Russian corporations under sanctions, and B-Crypto, a Moscow startup, for its cryptocurrency-based cross-border settlements. Other companies, such as Masterchain and Lighthouse, were sanctioned for their roles in developing solutions for Russian banks and facilitating digital asset transactions, respectively.

Echelon Companies, closely linked to the Kremlin through the Echelon Union for Science and Technology, were sanctioned for their relationships with the conglomerate.

The implications of these sanctions are rather far-reaching, affecting the property and transactions of the designated individuals and entities within the US jurisdiction, and pose significant risks for foreign financial institutions engaging with Russia’s military-industrial base.